We help

scale up startups

investors and startups

Falconry VC

is a Kazakhstan and CIS-focused VC Fund

The Fund invests in the world's most promising companies with disruptive ideas and great return potential. We invest in early and growth stage startup companies in various sectors. The Fund is run by Falconry Capital which enjoys 15-years’ experience in successfully investing in the capital markets.

$ 20 mln

up to $150 thsd

$3.1 bln

What we

do

We study the best international experience, support the development

of the VC industry and ecosystem in Kazakhstan and

Central Asia, get acquainted with promising teams, invest in the capital

of companies, assist in the growth and scaling up of projects

in various sectors

in early and growth stage (pre-seed, seed, pre-IPO)

and support

their growth

from projects

within 5 years

We foster innovation and

work together to find

and grow breakthroughs

all over the world

We help

Help in finding projects

Due diligence.

Expertise.

Acceleration with our partners MOST Incubator

New services

New teams.

How Falconry operates

and invite co-investors

experts

startups

in selected projects

projects

with high returns

We DO NOT consider companies:

- without the potential to reach a capitalization of $100 mln+;

- at the presentation stage (MVP is a minimum requirement);

- outside IT: investments in real estate, mineral resources, etc.;

- with founders running several businesses simultaneously;

- with the need in debt financing;

- with the focus on crypto investments.

Required documents for the project to be considered

Business plan

on a confidentiality basis, with a 5 year forecast.

The business-plan is to contain the sections, as follows:

- a project summary

- a project description

- a product description

- a market analysis and marketing strategy

- an operational / financial plan

- management and shareholders

- a proposed structure of the deal (financing size, structure)

- exity strategy

Financial Statements

for last 3 years (preferably audited):

- balance sheet

- profit and loss statement

- cash flow statement

Site visit

for making a site visit of the Project.

If the project has been approved

to participate in the project,

the company should be prepared to:

as a Board Director

organizational structure

(if necessary)

operational and financial

statements to the Fund

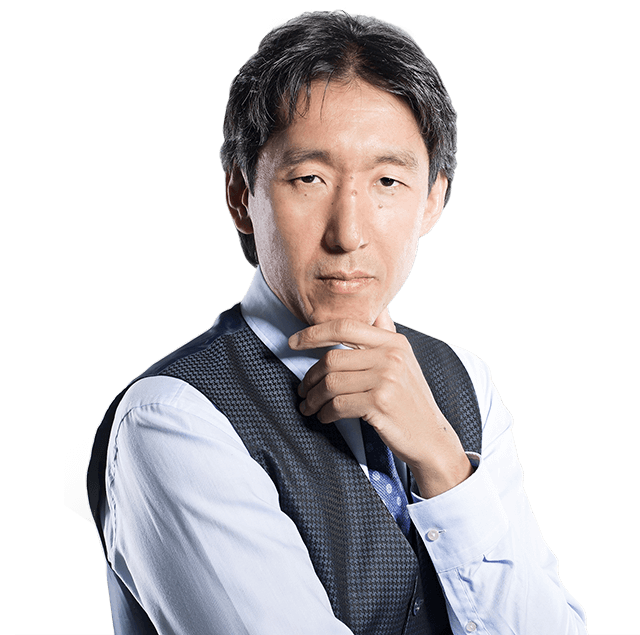

Bakht Niyazov

From 1997 through 2003, Bakht Niyzov worked for the state system for securities market regulation and was a Board Director at the Kazakhstan Stock Exchange (KASE).

In 2004, he founded the broker company Real-invest.kz. Over 4 years, the company has become one of the leading brokers on Kazakh stock market the company’s capitalization rose from $50 thousand up to $25 million. Under Niyzov’s management, Reak-invest.kz participated in market launch of shares and bonds of 10 companies, among them were Food Contract Corporation, ATFBank, Kazakhaltyn, Kazakhstan Engineering. The total amount of deals exceeds $500 million.

Besides the stock market, Bakht Niyazov has vast experience in private equity investment.

In 2009, he founded microfinance company Real-Credit, one of most successful micro-finance lender in Kazakhstan by profitability, and loan size.

In 2014, he he cofounded Moscow based technology and transportation startup, which innovates at the intersection of lifestyle and logistics. Today company services nearly 90% five-star hotels in Moscow.

In 2010, he launched investment company in DIFC, financing projects in international markets.

In 2015, he became a co-founder of MeiraGtx, a revolutionary project in biotechnologies.

Married, has three children.

Bakht is an activist for sustainable development of Kazakhstan, in 2015, he founded Kazakhstan’s Council for Green Building “KazGBC”.

Author of more than 50 publications on topic of Economics, Finance and Leadership.

and investment industries

of more than 18 years.

Under his management, Falconry capital

was among the top-3 in terms

of trading activities on KASE.

management $15 million. The funds

under his management were among

the top-3 on return

rated by investfunds.kz

management in manufacturing.

Experience in managing assets

of industrial businesses -

exceeds 18 years.

an investment company in Germany.

Experience in managing hedge-funds,

pension funds in Germany.

Vast experience in analyzing projects

in PE.

A unique expertise

by Falconry over

15 years on the

in Kazakhstan, RIG has provided superior service to its clients

since 2003 with $60 mln asset size

and listing of equity and bonds

on Kazakh stock exchange.

microfinance lender

“Real-Credit”.

one of the largest vanadium mines in the world.

and transportation startup. Today company services

nearly 90% five-star hotels in Moscow

biotechnological project for gene therapy MeigaGTX (USA).

The company delivered its successful IPO

on the NASDAQ in 2018.

a unique concept based on “Green” technologies.

to make leather shoes in Kazakhstan

under the brand name “SHOES REPUBLIC”.